Table of Contents

Economic Functions of Financial Intermediaries

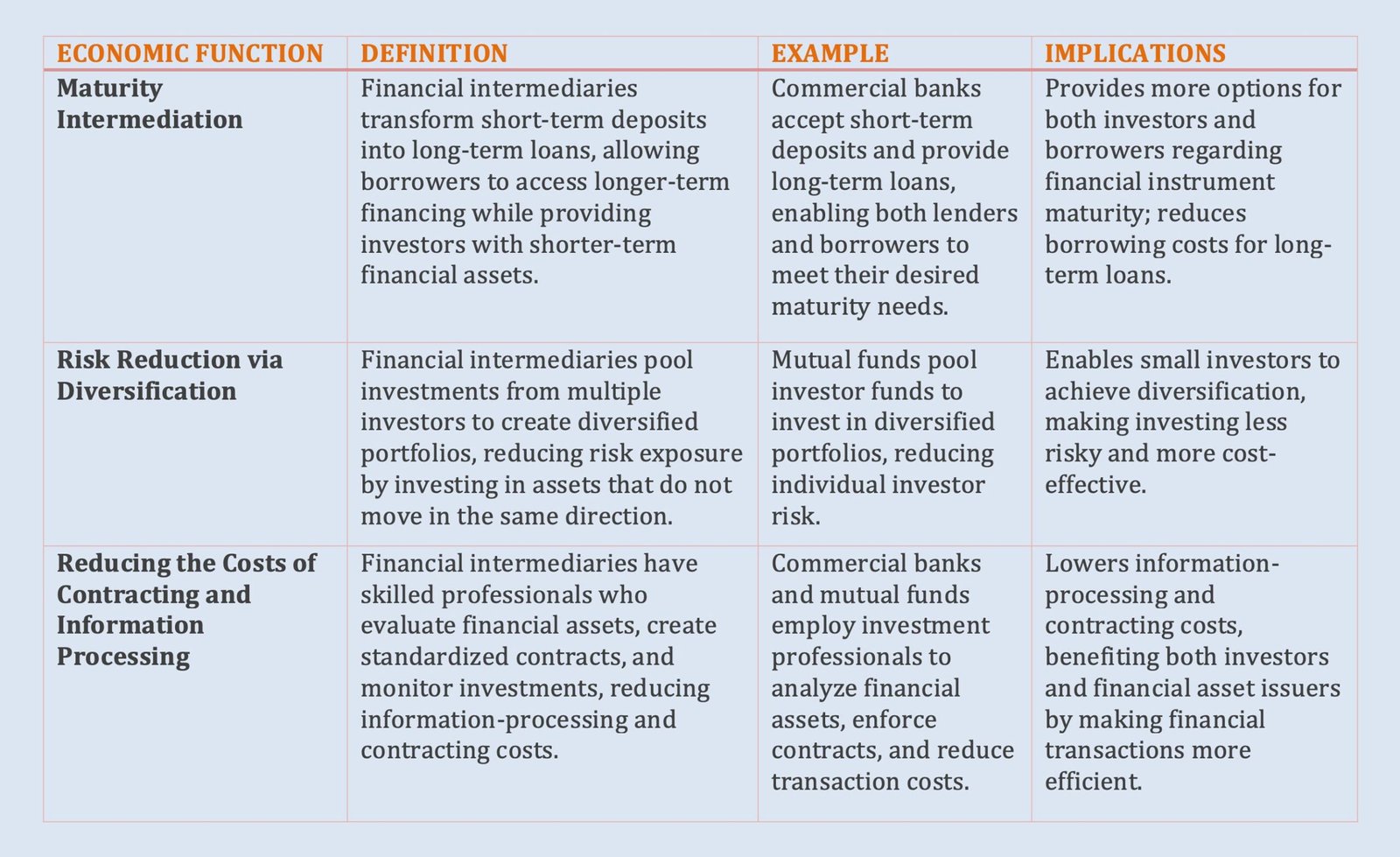

There are three economic functions of financial intermediaries when they transform financial assets:

- Maturity Intermediation

- Risk Reduction via Diversification

- Reducing the Costs of Contracting and Information Processing

Maturity Intermediation

Example (1): A commercial bank is a type of depository institution. Everyone knows that a bank accepts deposits from individuals, corporations, and governments. These depositors are the lenders to the commercial bank. The funds received by the commercial bank become the liability of the commercial bank. In turn, as explained later, a bank lends these funds by either making loans or buying securities. The loans and securities become the assets of the commercial bank.

You should note two things. First, the deposits’ maturity is typically short-term. Banks hold deposits that are payable upon demand or have a specific maturity date, and most are less than three years. Second, the maturity of the loans made by a commercial bank may be considerably longer than three years. Think about what would happen if commercial banks did not exist in a financial system.

In this scenario, borrowers would have to either (1) borrow for a shorter term in order to match the length of time lenders are willing to loan funds; or (2) locate lenders that are willing to invest for the length of the loan sought.

Now put commercial banks back into the financial system. By issuing its own financial claims, the commercial bank, in essence, transforms a longer-term asset into a shorter-term one by giving the borrower a loan for the length of time sought and the depositor—who is the lender—a financial asset for the desired investment horizon. We refer to this function of a financial intermediary as maturity intermediation.

The implications of maturity intermediation for financial systems are twofold. The first implication is that lenders/investors have more choices with respect to the maturity for the financial instruments in which they invest and borrowers have more alternatives for the length of their debt obligations.

The second implication is that because investors are reluctant to commit funds for a long time, they require long-term borrowers to pay a higher interest rate than on short-term borrowing. However, a financial intermediary is willing to make longer-term loans, and at a lower cost to the borrower than an individual investor would because the financial intermediary can rely on successive funding sources over a long time period (although at some risk).

For example, a depository institution can reasonably expect to have successive deposits to be able to fund a longer-term investment. As a result of this intermediation, the cost of longer-term borrowing is likely reduced in an economy.

Risk Reduction via Diversification

Example (2): A mutual fund is one type of regulated investment company. A mutual fund accepts funds from investors who, in exchange, receive mutual fund shares. In turn, the mutual fund invests those funds in a portfolio of financial instruments. The mutual fund shares represent an equity interest in the portfolio of financial instruments, and the financial instruments are the assets of the mutual fund.

Suppose that the mutual fund invests the funds received from investors in the stock of a large number of companies. By doing so, the mutual fund diversifies and reduces its risk. Diversification is the reduction in risk from investing in assets whose returns do not move in the same direction at the same time.

Investors with a small sum to invest would find it difficult to achieve the same degree of diversification as a mutual fund because of their lack of sufficient funds to buy shares of a large number of companies. Yet by investing in the mutual fund for the same dollar investment, investors can achieve this diversification, thereby reducing risk.

Financial intermediaries perform the economic function of diversification, transforming more risky assets into less risky ones. Though individual investors with sufficient funds can achieve diversification on their own, they may not be able to accomplish it as cost-effectively as financial intermediaries.

Realising cost-effective diversification in order to reduce risk by purchasing the financial assets of a financial intermediary is an important economic benefit for financial systems.

Reducing the Costs of Contracting and Information Processing

Investors purchasing financial assets must develop skills necessary to evaluate their risk and return. After developing the necessary skills, investors can apply them in analyzing specific financial assets when contemplating their purchase or subsequent sale. Investors who want to make a loan to a consumer or business need to have the skill to write a legally enforceable contract with provisions to protect their interests.

After investors make this loan, they would have to monitor the financial condition of the borrower and, if necessary, pursue legal action if the borrower violates any provisions of the loan agreement. Although some investors might enjoy devoting leisure time to this task if they had the prerequisite skill set, most find leisure time to be in short supply and want compensation for sacrificing it. The form of compensation could be a higher return obtained from an investment.

In addition to the opportunity cost of the time to process the information about the financial asset and its issuer, we must consider the cost of acquiring that information. Such costs are information-processing costs. The costs associated with writing loan agreements are contracting costs. Another aspect of contracting costs is the cost of enforcing the terms of the loan agreement.

With these points in mind, consider our two examples of financial intermediaries:

- The commercial bank

- The mutual fund

The staff of these two financial intermediaries include investment professionals trained to analyze financial assets and manage them. In the case of loan agreements, either standardized contracts may be prepared, or legal counsel can be part of the professional staff to write contracts involving transactions that are more complex.

Investment professionals monitor the activities of the borrower to assure compliance with the loan agreement’s terms and, where there is any violation, take action to protect the interests of the financial intermediary.

It is clearly cost-effective for financial intermediaries to maintain such staffs because investing funds is their normal business.

There are economies of scale that financial intermediaries realize in contracting and processing information about financial assets because of the amount of funds that they manage.

These reduced costs, compared to what individual investors would have to incur to provide funds to those who need them, accrue to the benefit of (1) investors who purchase a financial claim of the financial intermediary; and (2) issuers of financial assets (a result of lower funding costs).