Table of Contents

The Capital Market

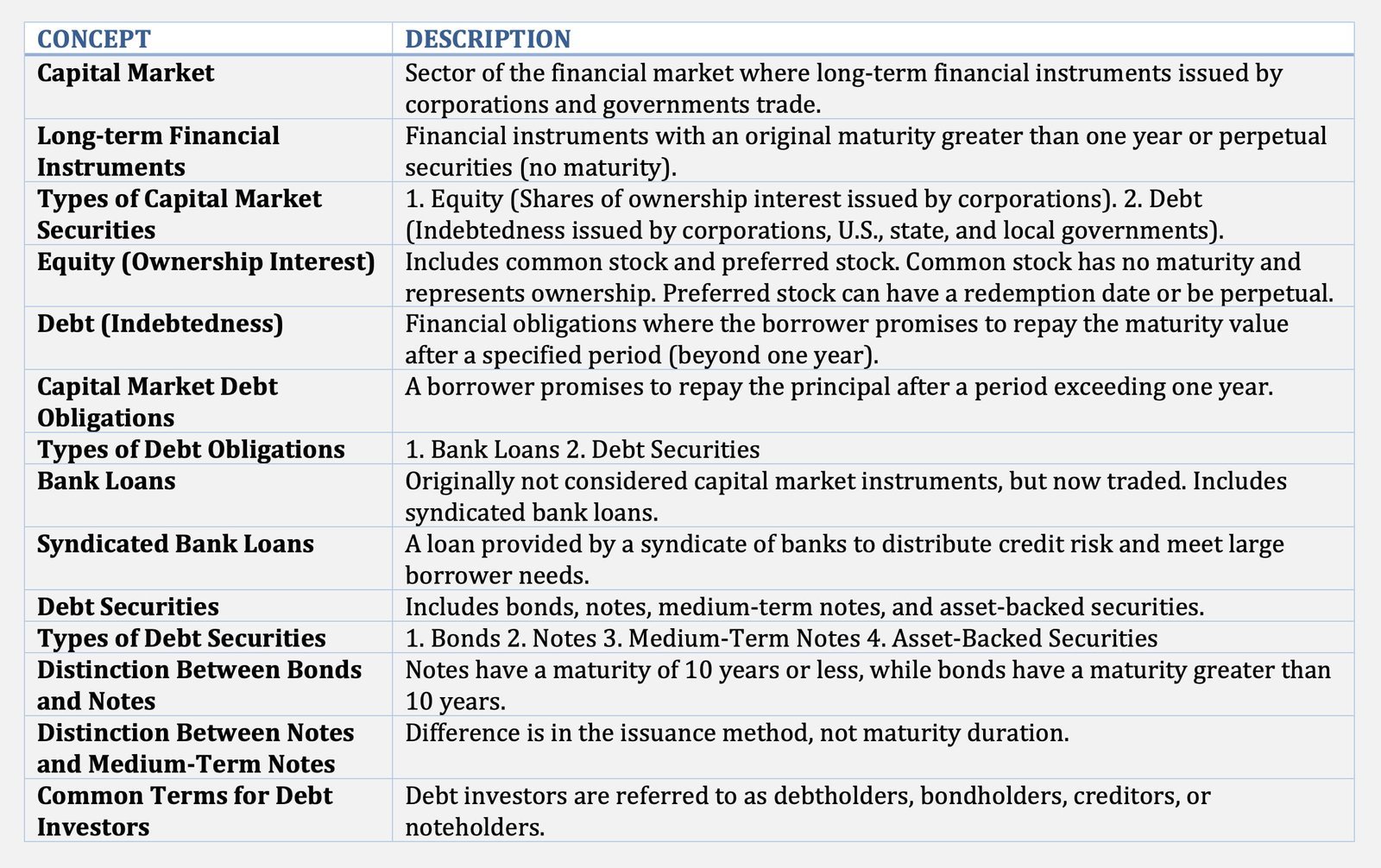

The capital market is the sector of the financial market where long-term financial instruments issued by corporations and governments trade.

Here “long-term” refers to a financial instrument with an original maturity greater than one year and perpetual securities (those with no maturity).

There are two types of capital market securities:

- Those that represent shares of ownership interest, also called equity, issued by corporations.

- Those that represent indebtedness, issued by corporations and by the U.S., state, and local governments.

Earlier we described the distinction between equity and debt instruments. Equity includes common stock and preferred stock. Because common stock represents ownership of the corporation, and because the corporation has a perpetual life, common stock is a perpetual security; it has no maturity. Preferred stock also represents ownership interest in a corporation and can either have a redemption date or be perpetual.

A capital market debt obligation is a financial instrument whereby the borrower promises to repay the maturity value at a specified period of time beyond one year.

We can break down these debt obligations into two categories:

- Bank Loans

- Debt Securities

Bank Loans

Bank loans were not considered capital market instruments, today there is a market for the trading of these debt obligations.

One form of such a bank loan is a syndicated bank loan. This is a loan in which a group (or syndicate) of banks provides funds to the borrower.

The need for a group of banks arises because the exposure in terms of the credit risk and the amount sought by a borrower may be too large for any one bank.

Debt Securities

Debt securities include (1) bonds, (2) notes, (3) medium-term notes, and (4) asset-backed securities. The distinction between a bond and a note has to do with the number of years until the obligation matures when the issuer originally issued the security.

Historically, a note is a debt security with a maturity at issuance of 10 years or less; a bond is a debt security with a maturity greater than 10 years.

The distinction between a note and a medium-term note has nothing to do with the maturity, but rather the method of issuing the security.

Throughout most of time, we refer to a bond, a note, or a medium term note as simply a bond. We will refer to the investors in any debt obligation as the debtholder, bondholder, creditor, or noteholder.