Table of Contents

Primary and Secondary Market

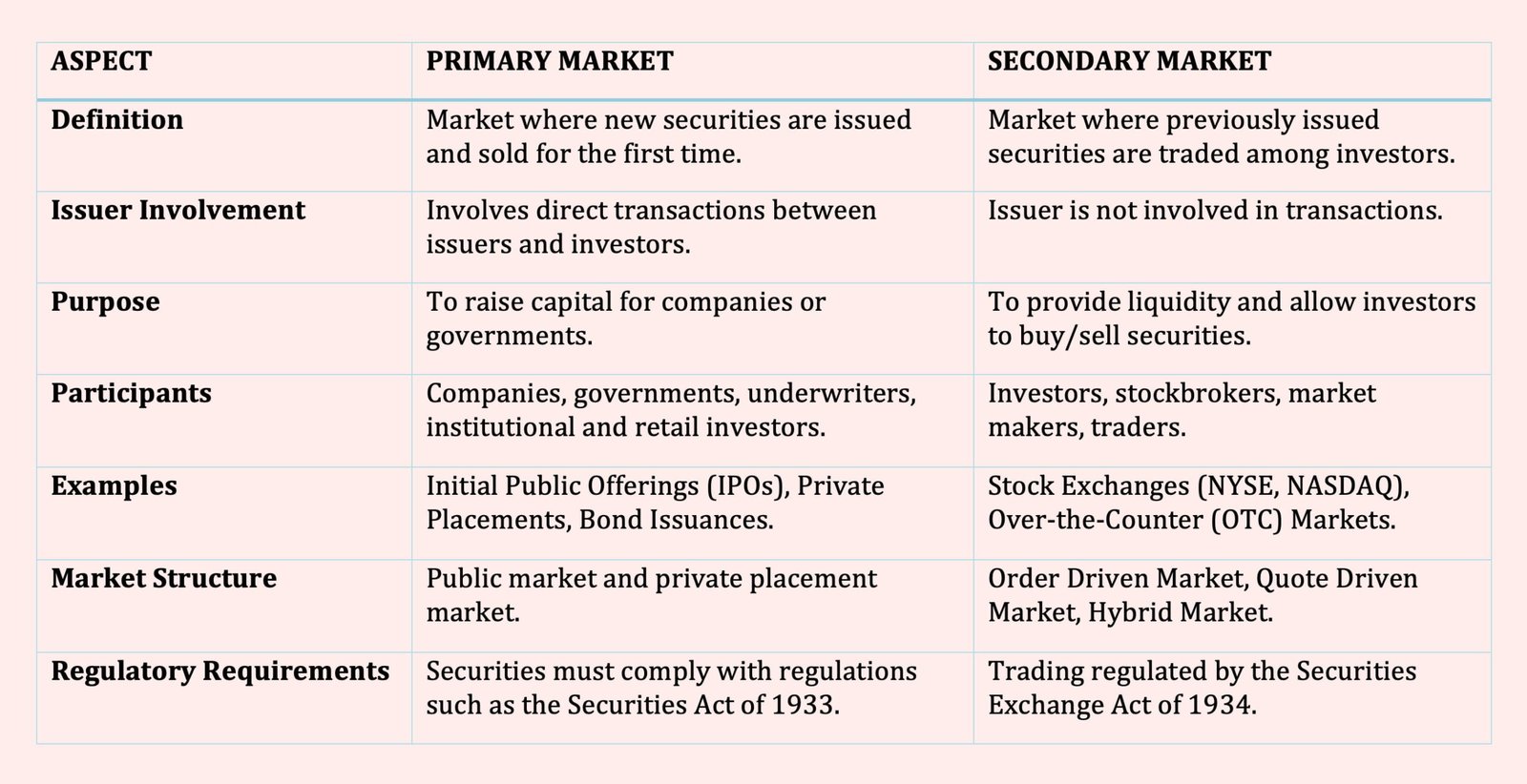

The primary market and secondary market are two key components of the financial market. The primary market is where securities, such as stocks and bonds, are issued for the first time by companies, governments, or other entities to raise capital.

Investors purchase these securities directly from the issuer, often through initial public offerings (IPOs) or private placements.

In contrast, the secondary market is where previously issued securities are traded among investors without involving the original issuer. This market includes stock exchanges like the New York Stock Exchange (NYSE) and the NASDAQ, where investors buy and sell shares based on supply and demand.

The Primary Market

When an issuer first issues a financial instrument, it is sold in the primary market. Companies sell new issues and thus raise new capital in this market. Therefore, it is the market whose sales generate proceeds for the issuer of the financial instrument. Issuance of securities must comply with the U.S. securities laws. The primary market consists of both a public market and a private placement market.

The public market offering of new issues typically involves the use of an investment bank. The process of investment banks bringing these securities to the public markets is underwriting. Another method of offering new issues is through an auction process. Bonds by certain entities such as municipal governments and some regulated entities are issued in this way.

There are different regulatory requirements for securities issued to the general investing public and those privately placed. The two major securities laws in the United States—the Securities Act of 1933 and the Securities Exchange Act of 1934—require that unless otherwise exempted, all securities offered to the general public must register with the SEC.

One of the exemptions set forth in the 1933 Act is for “transactions by an issuer not involving any public offering.” We refer to such offerings as private placement offerings. Prior to 1990, buyers of privately placed securities were not permitted to sell these securities for two years after acquisition. SEC Rule 144A, approved by the SEC in 1990, eliminates the two-year holding period if certain conditions are met. As a result, the private placement market is now classified into two categories: Rule 144A offerings and non-Rule 144A (commonly referred to as traditional private placements).

The Secondary Market

A secondary market is one in which financial instruments are resold among investors. Issuers do not raise new capital in the secondary market and, therefore, the issuer of the security does not receive proceeds from the sale. Trading takes place among investors. Investors who buy and sell securities on the secondary markets may obtain the services of stockbrokers, entities who buy or sell securities for their clients.

Market Structure

We categorize secondary markets based on the way in which they trade, referred to as market structure.

There are two overall market structures for trading financial instruments:

- Order Driven Market

- Quote Driven Market

Market structure is the mechanism by which buyers and sellers interact to determine price and quantity.

Order Driven Market

In an order-driven market structure, buyers and sellers submit their bids through their broker, who relays these bids to a centralized location for bid-matching, and transaction execution. We also refer to an order-driven market as an auction market.

Quote Driven Market

In a quote-driven market structure, intermediaries (market makers or dealers) quote the prices at which the public participants trade.

Market makers provide a bid quote (to buy) and an offer quote (to sell), and realize revenues from the spread between these two quotes. Thus, market makers derive a profit from the spread and the turnover of their inventory of a security.

There are hybrid market structures that have elements of both a quote driven and order driven market structure.

We can also classify secondary markets in terms of organized exchanges and over-the-counter markets.

- Exchanges

- Over-the-Counter Market (OTC Market)

Exchanges

Exchanges are central trading locations where financial instruments trade. The financial instruments must be those listed by the organized exchange. By listed, we mean the financial instrument has been accepted for trading on the exchange. To be listed, the issuer must satisfy requirements set forth by the exchange.

In the case of common stock, the major organized exchange is the New York Stock Exchange (NYSE). For the common stock of a corporation to list on the NYSE, for example, it must meet minimum requirements for pretax earnings, net tangible assets, market capitalization, and number and distribution of shares publicly held. In the United States, the SEC must approve the market to qualify it as an exchange.

Over-the-Counter Market (OTC Market)

An over-the-counter market (OTC market) is generally where unlisted financial instruments trade. For common stock, there are listed and unlisted stocks. Although there are listed bonds, bonds are typically unlisted and therefore trade over-the-counter. The same is true of loans. The foreign exchange market is an OTC market. There are listed and unlisted derivative instruments.