Table of Contents

Market Efficiency

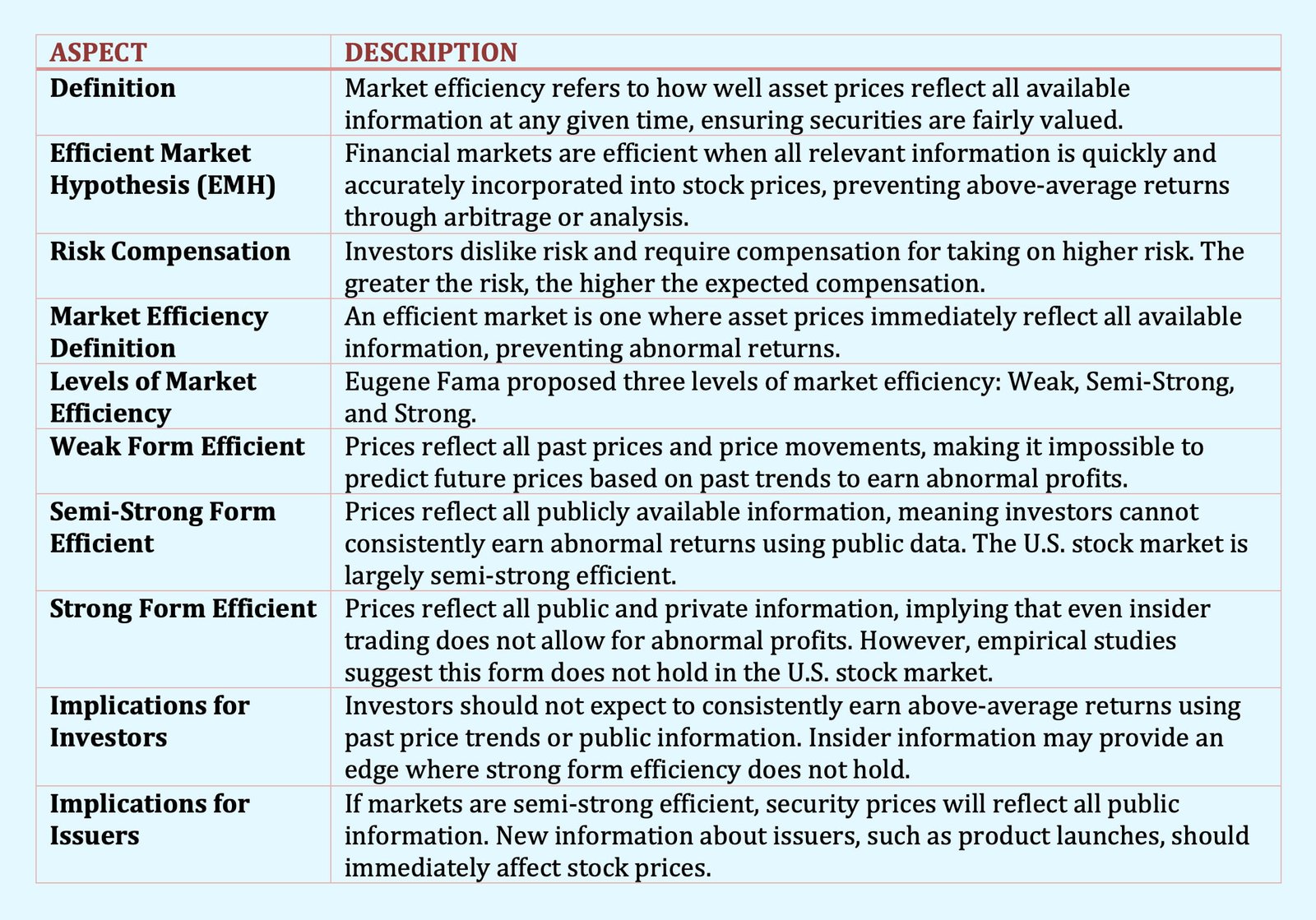

Market efficiency refers to the degree to which asset prices fully reflect all available information at any given time, ensuring that securities are fairly valued based on their intrinsic worth.

According to the Efficient Market Hypothesis (EMH), financial markets operate efficiently when all relevant information is quickly and accurately incorporated into stock prices, leaving no room for investors to consistently achieve above-average returns through arbitrage or analysis.

Investors do not like risk and they must be compensated for taking on risk—the larger the risk, the more the compensation.

We refer to how efficiently a financial market prices the assets traded in that market as market efficiency. A price-efficient market, or simply an efficient market, is a financial market where asset prices rapidly reflect all available information. This means that all available information is already impounded into an asset’s price, so investors should expect to earn a return necessary to compensate them for their anticipated risk. That would seem to preclude abnormal returns.

But, according to Eugene Fama, there are the following three levels of market efficiency:

- Weak Form Efficient

- Semi Strong Form Efficient

- Strong Form Efficient

Weak Form Efficient

In the weak form of market efficiency, current asset prices reflect all past prices and price movements. In other words, all worthwhile information about historical prices of the stock is already reflected in today’s price; the investor cannot use that same information to predict tomorrow’s price and still earn abnormal profits.

Semi Strong Form Efficient

In the semi-strong form of market efficiency, the current asset prices reflect all publicly available information. The implication is that if investors employ investment strategies based on the use of publicly available information, they cannot earn abnormal profits.

This does not mean that prices change instantaneously to reflect new information, but rather that asset prices reflect this information rapidly. Empirical evidence supports the idea that the U.S. stock market is for the most part semi-strong form efficient. This, in turn, implies that careful analysis of companies that issue stocks cannot consistently produce abnormal returns.

Strong Form Efficient

In the strong form of market efficiency, asset prices reflect all public and private information. In other words, the market (which includes all investors) knows everything about all financial assets, including information that has not been released to the public.

The strong form implies that investors cannot make abnormal returns from trading on inside information, information that has not yet been made public. In the U.S. stock market, this form of market efficiency is not supported by empirical studies.

In fact, we know from recent events that the opposite is true; gains are available from trading on inside information. Thus, the U.S. stock market, the empirical evidence suggests, is essentially semi-strong efficient but not in the strong form.

The implications for market efficiency for issuers are that if the financial markets in which they issue securities are semi-strong efficient, issuers should expect investors to pay a price for those shares that reflects their value.

This also means that if new information about the issuer is revealed to the public (for example, concerning a new product), the price of the security should change to reflect that new information.