Table of Contents

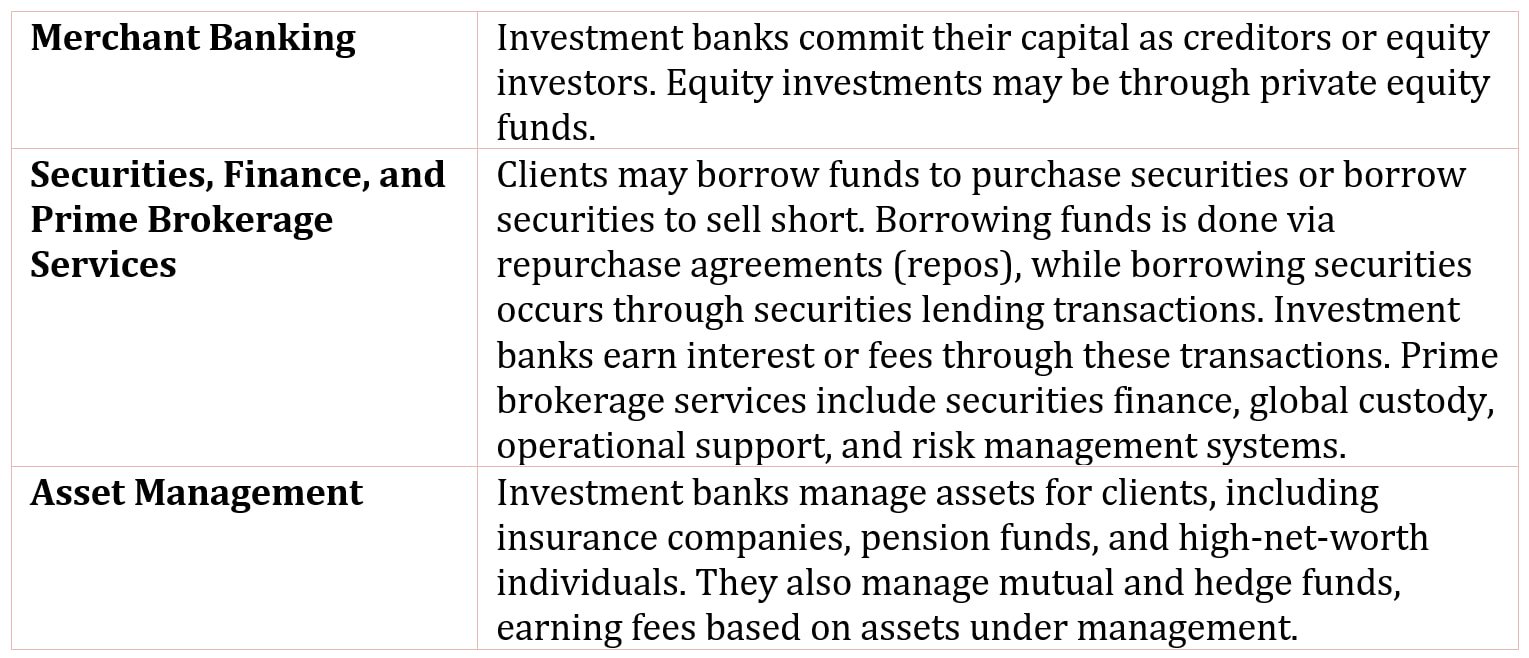

Merchant Banking

The activity of merchant banking is one in which the investment bank commits its own capital as either a creditor or to take an equity stake.

There are divisions or groups within an investment bank devoted to merchant banking. In the case of equity investing, this may be in the form of a series of private equity funds.

Securities, Finance, and Prime Brokerage Services

There are clients of investment banks that, as part of their investment strategy, may need to either:

- Borrow funds in order to purchase a security.

- Borrow securities in order to sell a security short or to cover a short sale.

The standard mechanism for borrowing funds in the securities market is via a repurchase agreement (referred to as a repo) rather through bank borrowing. A repo is a collateralized loan where the collateral is the security purchased. Investment banks earn interest on repo transactions.

A customer can borrow a security in a transaction known as a securities lending transaction. In such transactions, the lender of the security earns a fee for lending the securities. The activity of borrowing funds or borrowing securities is referred to as securities finance.

Investment banks may provide a package of services to hedge fund and large institutional investors. This package of services, referred to as prime brokerage, includes securities finance that we just described as well as global custody, operational support, and risk management systems.

Asset Management

An investment bank may have one or more subsidiaries that manage assets for clients such as insurance companies, endowments, foundations, corporate and public pension funds, and high-net-worth individuals.

These asset management divisions may also manage mutual funds and hedge funds. Asset management generates fee income based on a percentage of the assets under management.