Investment Management

Investment management is the specialty area within finance dealing with the management of individual or institutional funds.

Other terms commonly used to describe this area of finance are asset management, portfolio management, money management, and wealth management. In industry jargon, an asset manager “runs money.”

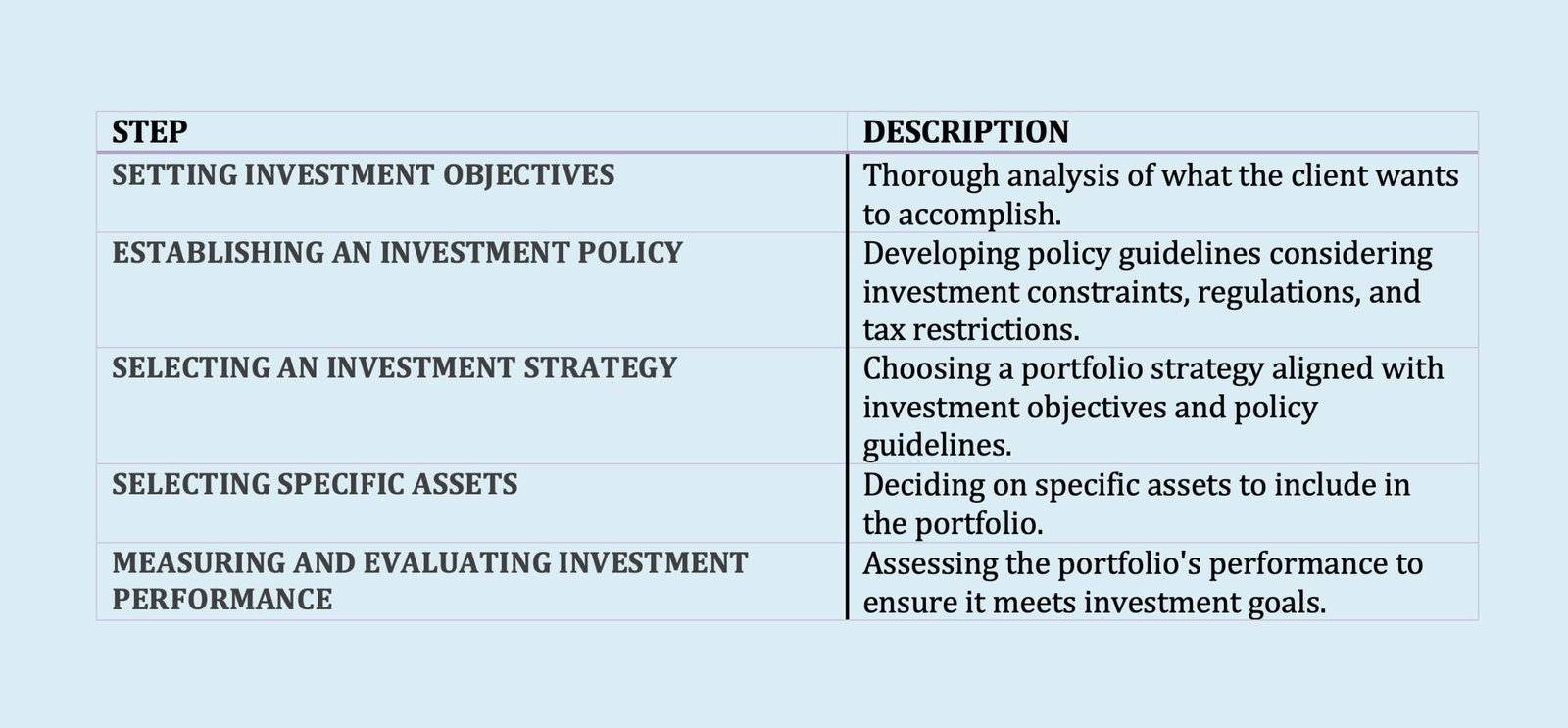

Investment management involves five primary activities, as you can be in above table. Setting investment objectives starts with a thorough analysis of what the entity or client wants to accomplish. Given the investment objectives, the investment manager develops policy guidelines, taking into consideration any client-imposed investment constraints, legal/regulatory constraints, and tax restrictions.

This task begins with the decision of how to allocate assets in the portfolio (i.e., how the funds are to be allocated among the major asset classes). The portfolio is simply the set of investments that are managed for the benefit of the client or clients. Next, the investment manager must select a portfolio strategy that is consistent with the investment objectives and investment policy guidelines.

In general, portfolio strategies are classified as either active or passive. Selecting the specific financial assets to include in the portfolio, which is referred to as the portfolio selection problem, is the next step. The theory of portfolio selection was formulated by Harry Markowitz in 1952.

This theory proposes how investors can construct portfolios based on two parameters: mean return and standard deviation of returns. The latter parameter is a measure of risk.

An important task is the evaluation of the performance of the asset manager. This task allows a client to determine answers to questions such as:

- How did the asset manager perform after adjusting for the risks associated with the active strategy employed?

- And, how did the asset manager achieve the reported return?