Table of Contents

Financial Statements

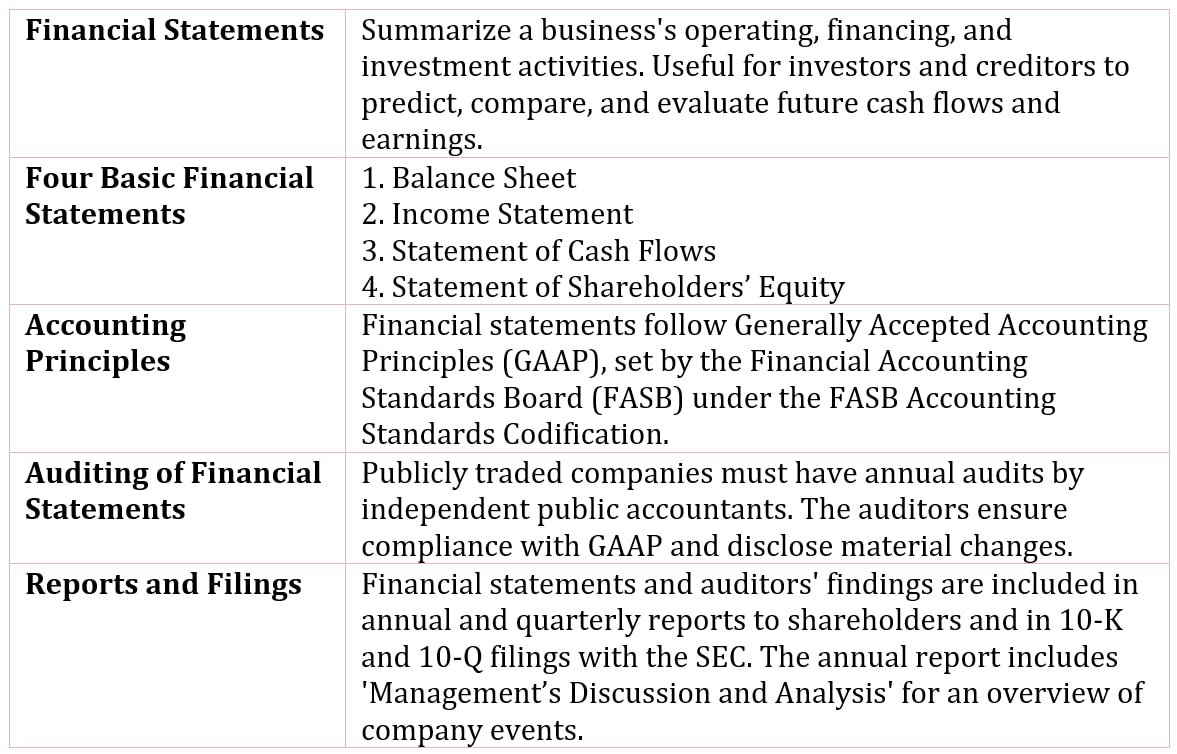

Financial statements are summaries of the operating, financing, and investment activities of a business.

Financial statements should provide information useful to both investors and creditors in making credit, investment, and other business decisions. And this usefulness means that investors and creditors can use these statements to predict, compare, and evaluate the amount, timing, and uncertainty of future cash flows.

In other words, financial statements provide the information needed to assess a company’s future earnings and, therefore, the cash flows expected to result from those earnings.

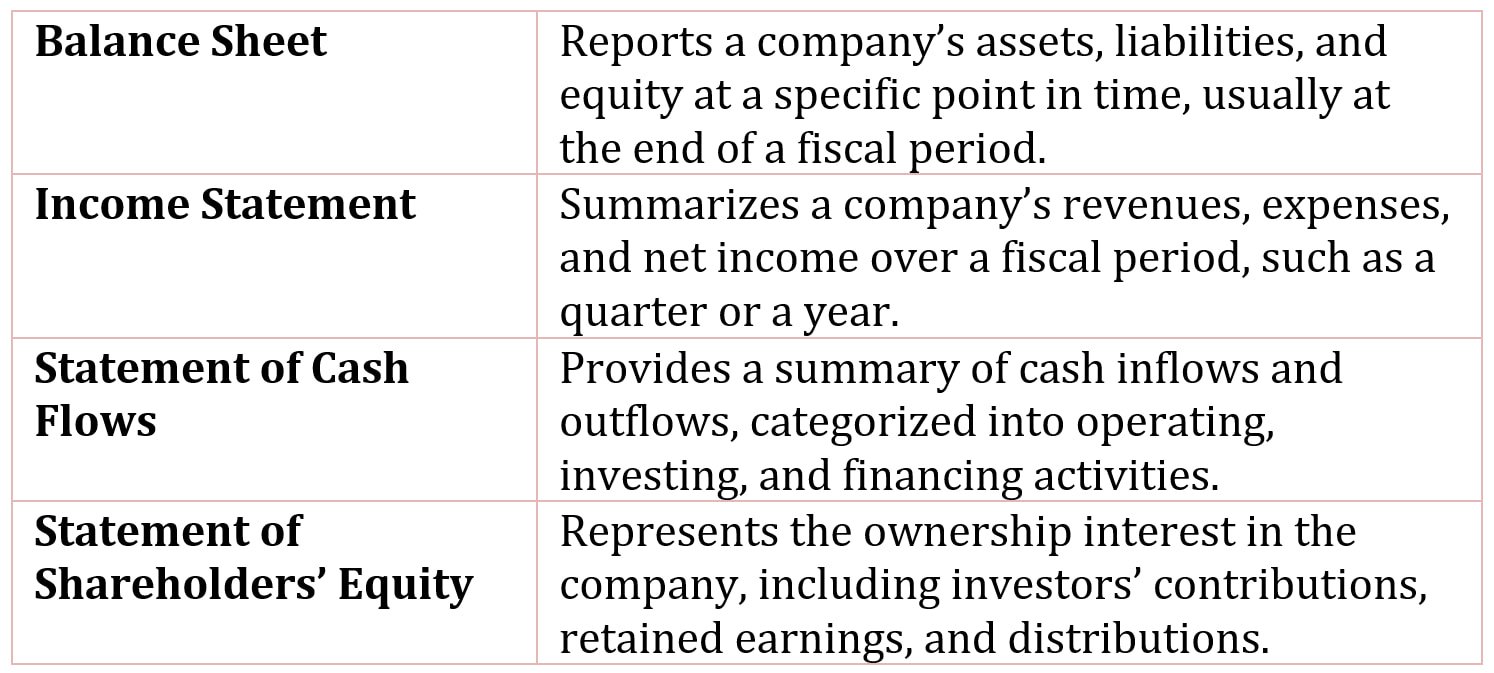

The four basic financial statements are:

- Balance sheet

- Income statement

- Statement of cash flows

- Statement of shareholders’ equity

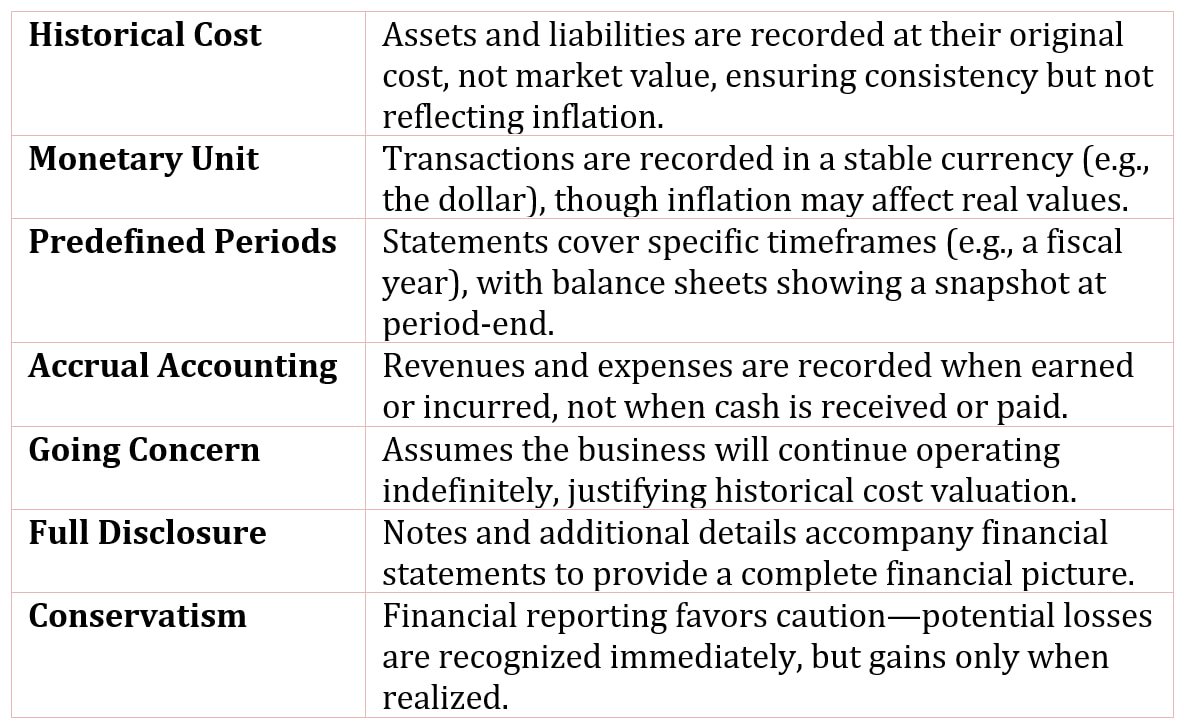

Accounting Principles of Financial Statements

The accounting data in financial statements are prepared by the company’s management according to a set of standards, referred to as generally accepted accounting principles (GAAP).

Generally accepted accounting principles are based on the codified standards promulgated by the Financial Accounting Standards Board (FASB), as part of the FASB Accounting Standards Codification.

Auditing of Financial Statements

The financial statements of a company whose stock is publicly traded must, by law, be audited at least annually by independent public accountants (i.e., accountants who are not employees of the company).

In such an audit, the accountants examine the financial statements and the data from which these statements are prepared and attest-through the published auditor’s opinion-that these statements have been prepared according to GAAP.

In this case, GAAP includes not only the FASB Accounting Standards Codification, but any rules and regulations of the Securities and Exchange Commission. The auditor’s opinion focuses whether the statements conform to GAAP and that there is adequate disclosure of any material change in accounting principles.

The financial statements and the auditors’ findings are published in the company’s annual and quarterly reports sent to shareholders and the 10-K and 10-Q filings with the Securities and Exchange Commission (SEC).

Also included in the reports, among other items, is a discussion by management, entitled “Management’s Discussion and Analysis of Financial Conditions and Results of Operations,” which is an overview of company events.

The annual reports are much more detailed and disclose more financial information than the quarterly reports.