Table of Contents

Domestic Financial Sectors

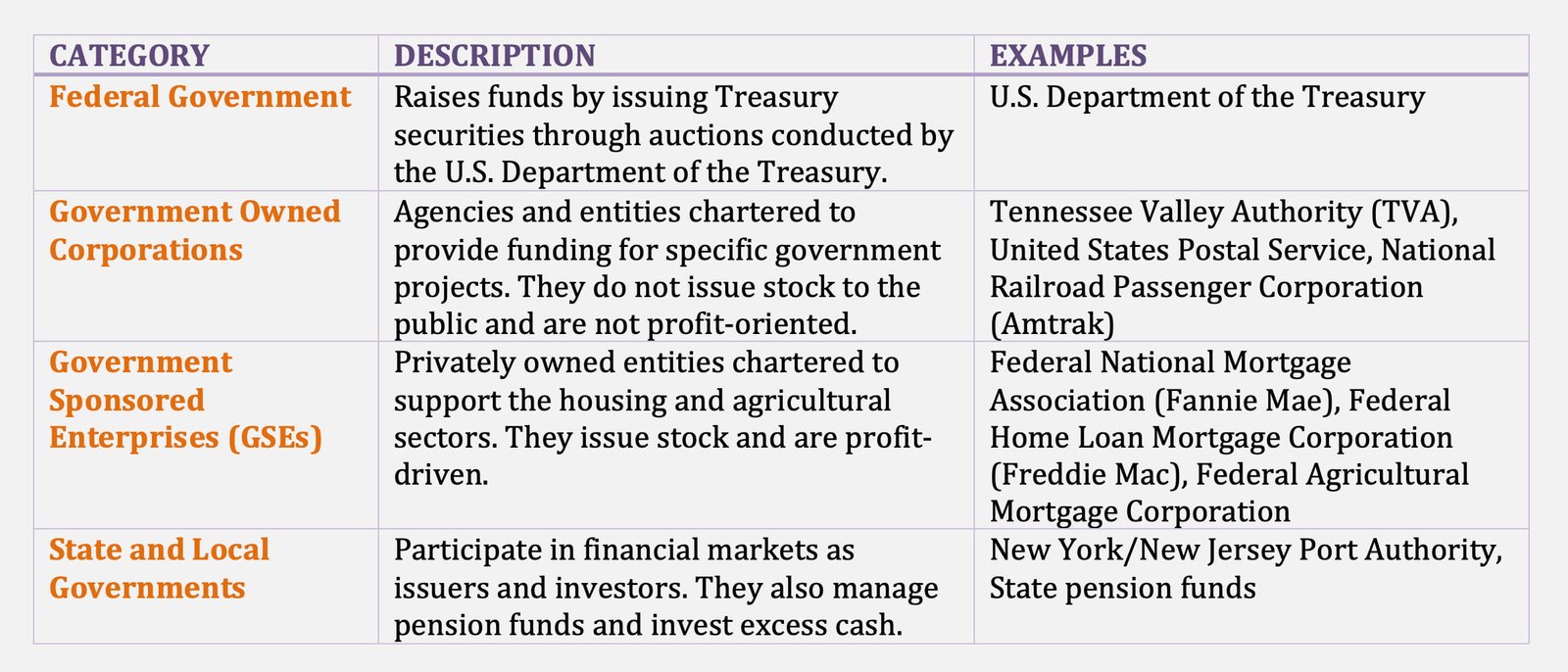

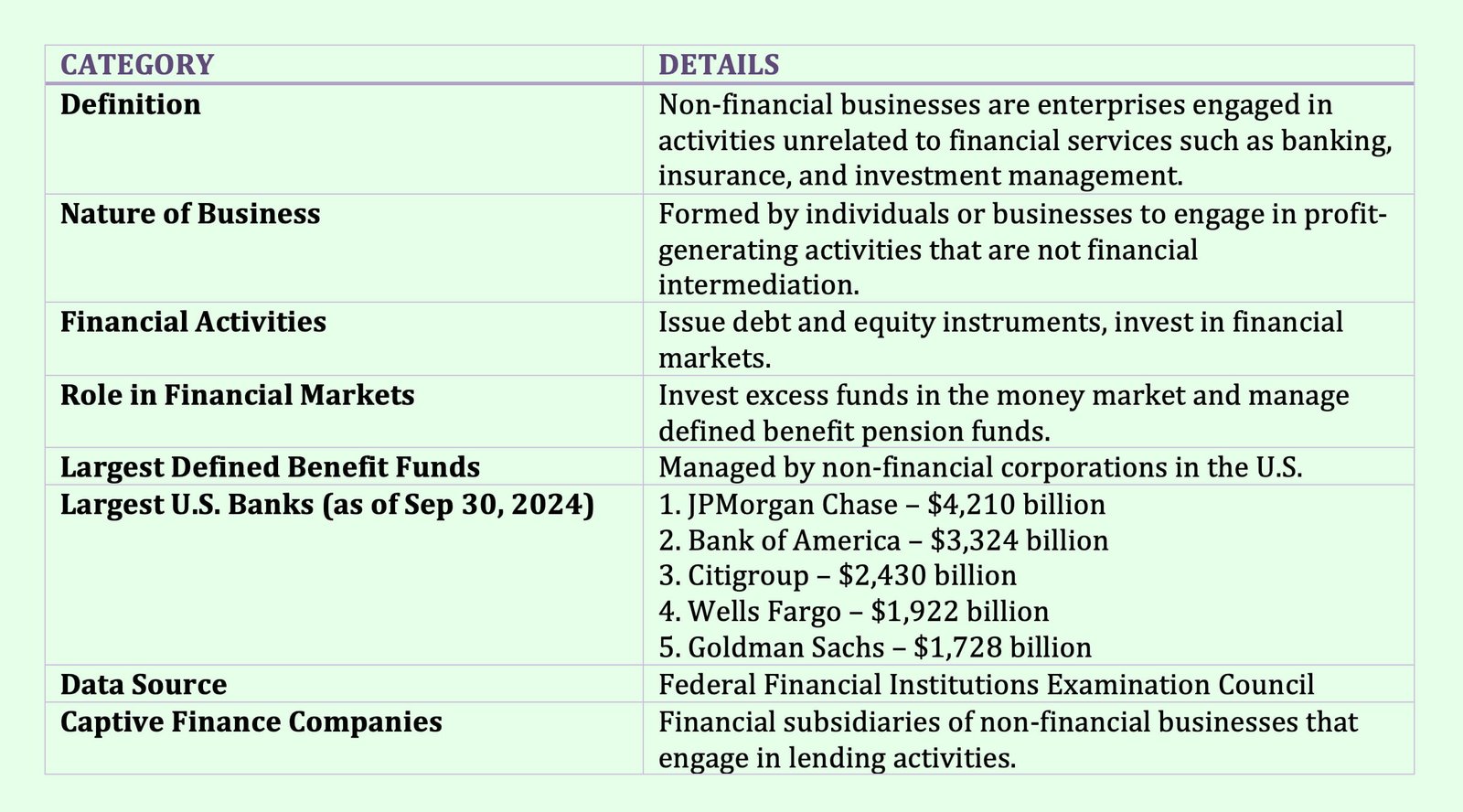

Domestic financial sectors include enterprises that and regulators that provide the framework for facilitating lending and borrowing.

We can classify these enterprises into different sectors, depending on the type of transactions they facilitate:

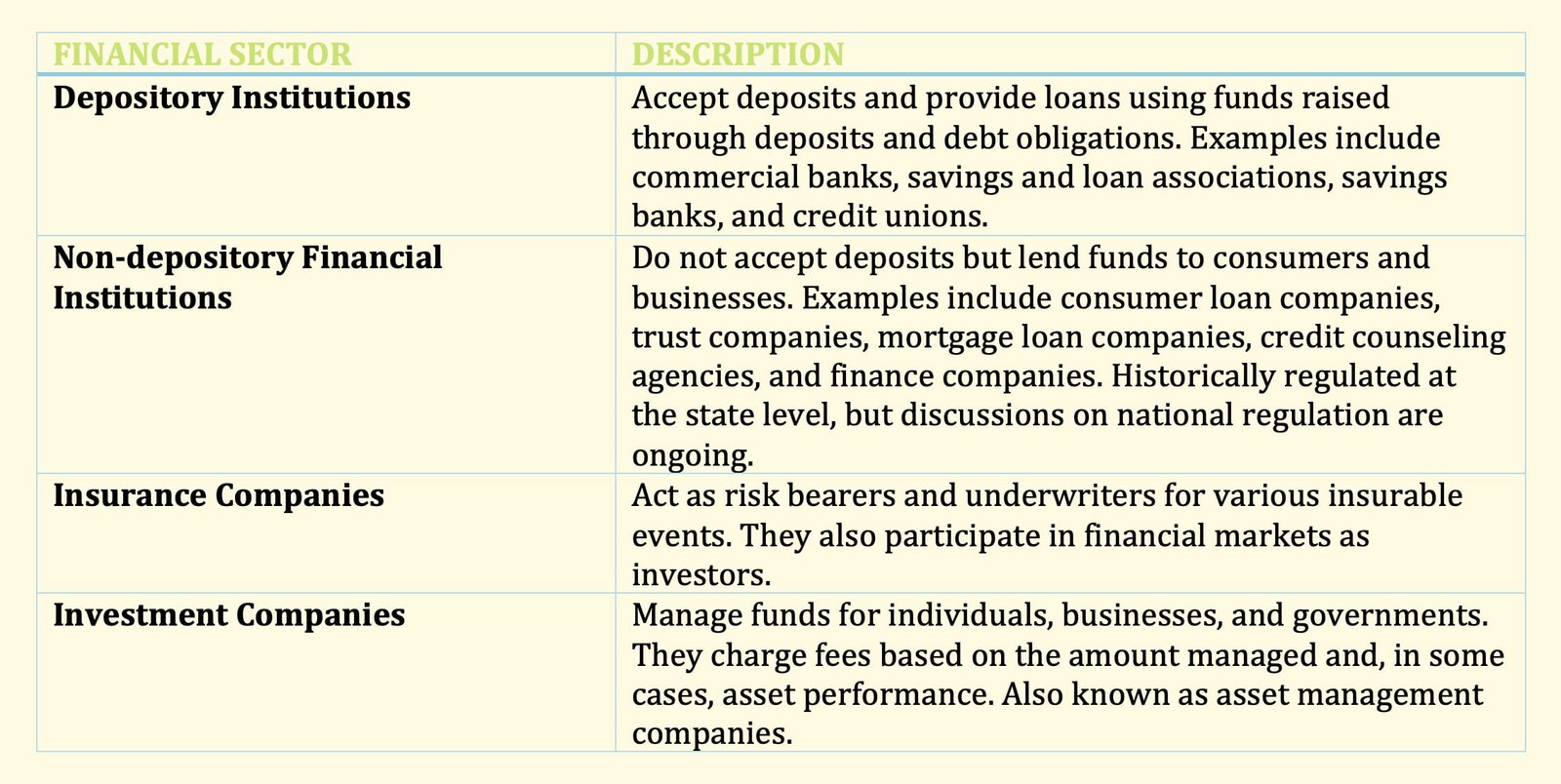

Depository Institutions

Depository institutions include commercial banks and thrifts. Thrifts include savings and loan associations, savings banks, and credit unions. As the name indicates, these entities accept deposits that represent the liabilities (i.e., debt) of the deposit-accepting institution. With the funds raised through deposits and non-deposit sources obtained by issuing debt obligations in the financial market, depository institutions make loans to various entities (businesses, consumers, and state and local governments).

Non-depository Financial Institutions

Non-depository financial institutions are intermediaries that do not accept deposits, but lend funds to consumers and businesses.6 Examples of these institutions include consumer loan companies, trust companies, mortgage loan companies, credit counseling agencies, and finance companies.

Unlike depository institutions, non-depository financial institutions have been regulated only at the state level in the U.S., but there is a current discussion on increased regulation of these institutions on the national level, especially in the case of failures of large non-depository financial institutions.

Insurance Companies

Insurance companies play an important role in an economy in that they are risk bearers or the underwriters of risk for a wide range of insurable events. Moreover, beyond their risk bearer role, insurance companies are major participants in the financial market as investors.

Investment Companies

Investment companies also known as asset management companies, manage the funds of individuals, businesses, and state and local governments, and are compensated for this service by fees that they charge. The fee is tied to the amount that is managed for the client and, in some cases, to the performance of the assets managed.