Table of Contents

Essential Investment Banking Services

Essential investment banking services consists capital raising, securities trading, mergers and acquisitions advisory, merchant banking, and asset management. These services support businesses, investors, and institutions in making strategic financial decisions, optimizing investments, and navigating complex financial transactions.

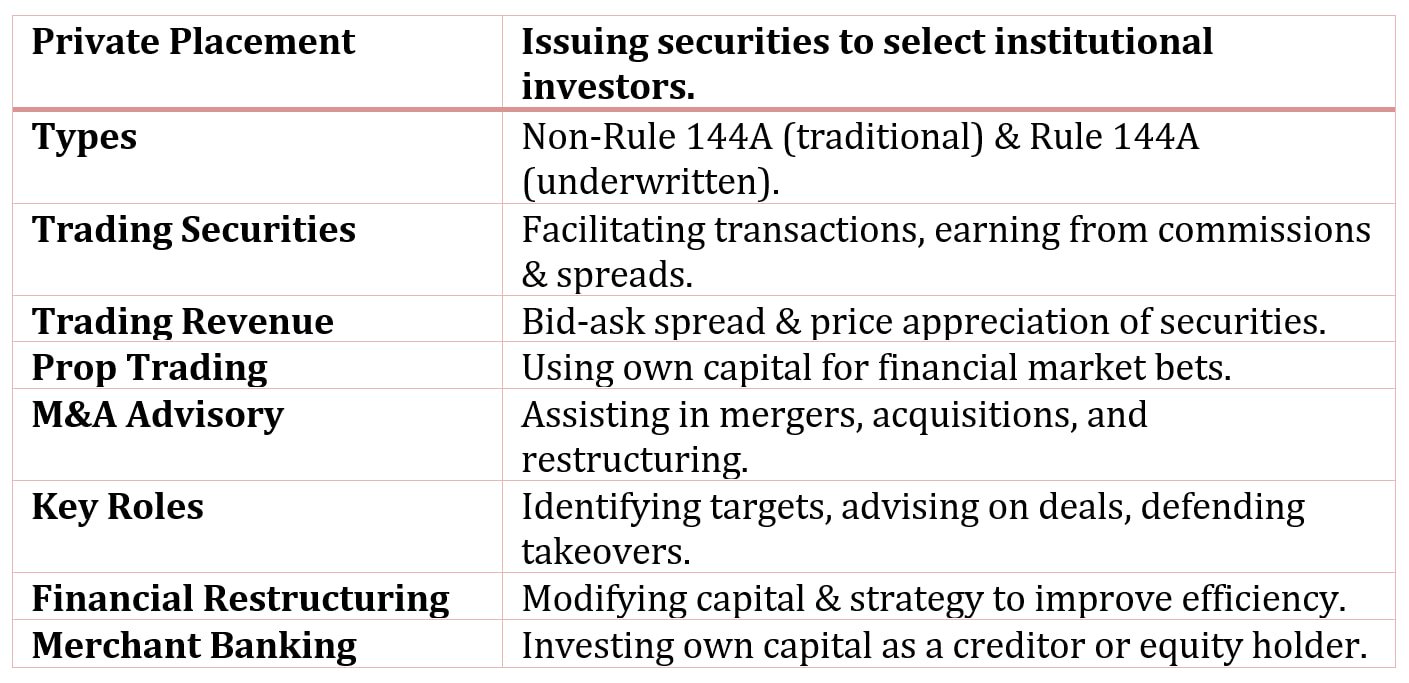

Private Placement of Securities

As an alternative to issuing a new security in the public market, a company can issue a security via a private placement to a limited number of institutional investors such as insurance companies, investment companies, and pension funds.

The Private placement offerings are distinguished by type:

- Non-Rule 144A offerings (traditional private placements)

- Rule 144A offerings

Rule 144A offerings are underwritten by investment bankers.

Trading Securities

An obvious activity of investment banks is providing transaction services for clients. Revenue is generated on transactions in which the investment bank acts as an agent or broker in the form of a commission. In such transactions, the investment bank is not taking a position in the transaction, meaning that it is not placing its own capital at risk. In other transactions, the investment bank may act as a market maker, placing its own capital at risk.

Revenue from this activity is generated through:

- The difference between the price at which the investment bank sells the security and the price paid for the securities (called the bid-ask spread).

- Appreciation of the price of the securities held in inventory. (Obviously, if the price of the securities decline, revenue will be reduced.)

In addition to executing trades in the secondary market for clients, as well as market making in the secondary market, investment banks do proprietary trading (referred to as prop trading). In this activity, the investment bank’s traders position some of the company’s capital to bet on movements in the price of financial instruments, interest rates, or foreign exchange.

Advising in Mergers, Acquisitions, and Financial Restructuring Advising

Investment banks are active in mergers and acquisitions (M&A), leveraged buyouts (LBOs), restructuring and recapitalization of companies, and reorganization of bankrupt and troubled companies.

They do so in one or more of the following ways:

- Identifying candidates for a merger or acquisition, M&A candidates.

- Advising the board of directors of acquiring companies or target companies regarding price and nonprice terms for an exchange.

- Assisting companies that are the target of an acquisition to fend off an unfriendly takeover attempt.

- Helping acquiring companies to obtain the needed funds to complete an acquisition.

- Providing a “fairness opinion” to the board of directors regarding a proposed merger, acquisition, or sale of assets.

Another area where investment banks advise is on a significant modification of a corporation’s capital structure, operating structure, and/or corporate strategy with the objective of improving efficiency. Such modifications are referred to as financial restructuring of a company.

This may be the result of a company seeking to avoid a bankruptcy, avoid a problem with creditors, or reorganize the company as permitted by the U.S. bankruptcy code.

The activities described above generate fee income that can either be a fixed retainer or in the case of consummating a merger or acquisition, a fee based on the size of the transaction. Thus, for most of these activities, the investment bank’s capital is not at risk.

However, if the investment bank provides financing for an acquisition, it does place its capital at risk. This brings us to the activity of merchant banking.

Merchant Banking

The activity of merchant banking is one in which the investment bank commits its own capital as either a creditor or to take an equity stake.