Table of Contents

Hedge Funds

Hedge funds are privately managed investment funds that pool capital from accredited or institutional investors to employ diverse and often complex investment strategies.

The term can also be defined by considering the characteristics most commonly associated with hedge funds. Usually, hedge funds:

- Are organised as private investment partnerships or offshore investment corporations.

- Use a wide variety of trading strategies involving position-taking in a range of markets.

- Employ an assortment of trading techniques and instruments, often including short-selling, derivatives, and leverage.

- Pay performance fees to their managers.

- Have an investor base comprising wealthy individuals and institutions and a relatively high minimum investment limit (set at US$100,000 or higher for most funds).

This definition helps us to understand several attributes of hedge funds. First and foremost, the word “hedge” in hedge funds is misleading because it is not a characteristic of hedge funds today. Second, hedge funds use a wide range of trading strategies and techniques in an attempt to not just generate abnormal returns but rather attempt to generate stellar returns regardless of how the market moves.

The strategies used by a hedge fund can include one or more of the following:

- Leverage, which is the use of borrowed funds

- Short selling, which is the sale of a financial instrument not owned in anticipation of a decline in that financial instrument’s price

- Derivatives to great leverage and control risk

- Simultaneous buying and selling of related financial instruments to realize a profit from the temporary misalignment of their prices

Hedge funds operate in sectors of the financial markets: cash market for stocks, bonds, and currencies, as well as in derivatives markets.

In evaluating hedge funds, investors are interested in the absolute return generated by the asset manager, not the relative return. Absolute return is simply the return realized rather than relative return, which is the difference between the realized return and the return on some benchmark or index, which is quite different from the criterion used when evaluating the performance of an asset manager.

The management fee structure for hedge funds is a combination of a fixed fee based on the market value of assets managed plus a share of the positive return. The latter is a performance-based compensation referred to as an incentive fee.

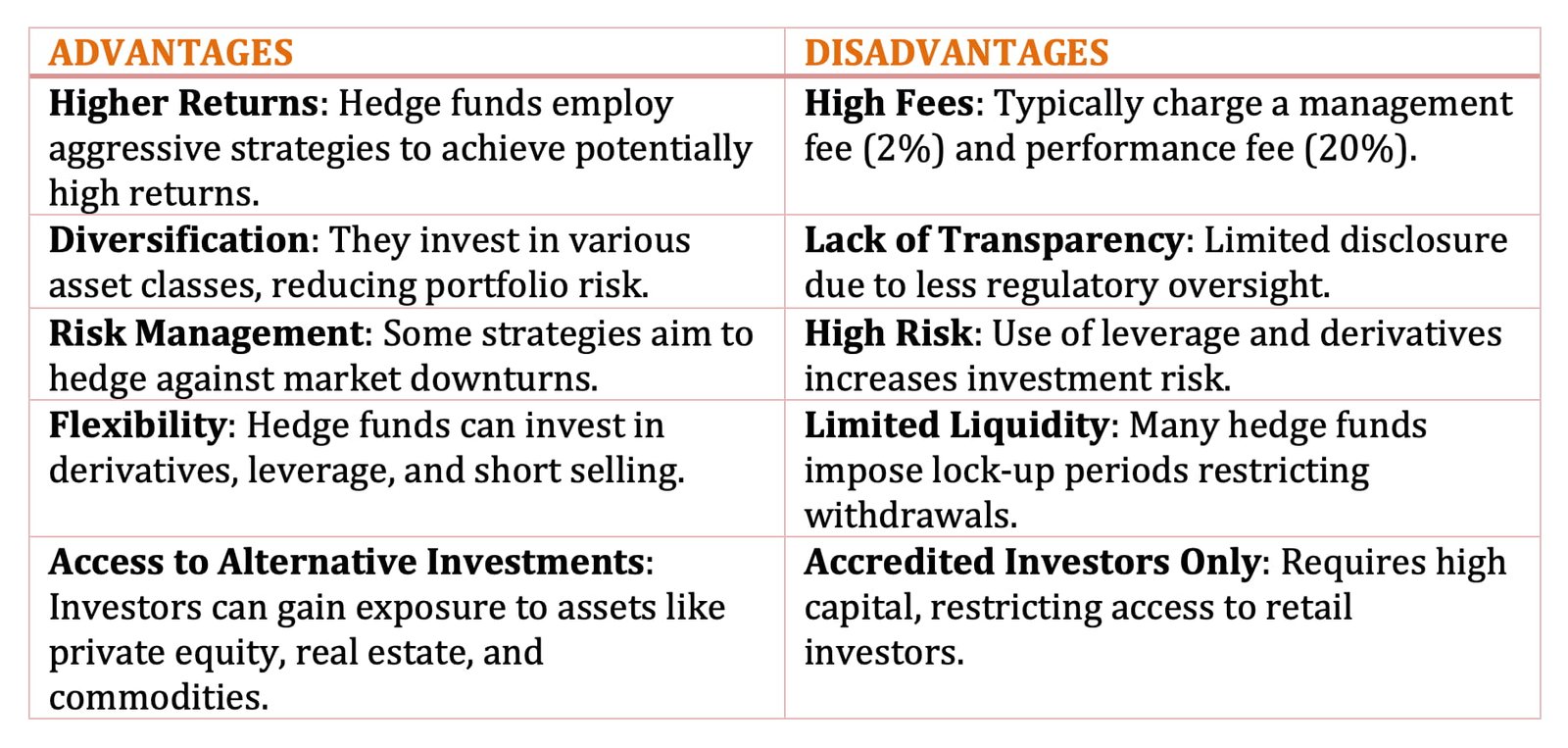

Advantages and Disadvantages of Hedge Funds