Table of Contents

Insurance Companies

Insurance companies play an important role in an economy in that they are risk bearers or the underwriters of risk for a wide range of insurable events. Moreover, beyond their risk bearer role, insurance companies are major participants in the financial market as investors.

As compensation for insurance companies selling protection against the occurrence of future events, they receive one or more payments over the life of the policy.

The payment that they receive is called a premium. Between the time that the premium is made by the policyholder to the insurance company and a claim on the insurance company is paid out (if such a claim is made), the insurance company can invest those proceeds in the financial market.

Insurance Products

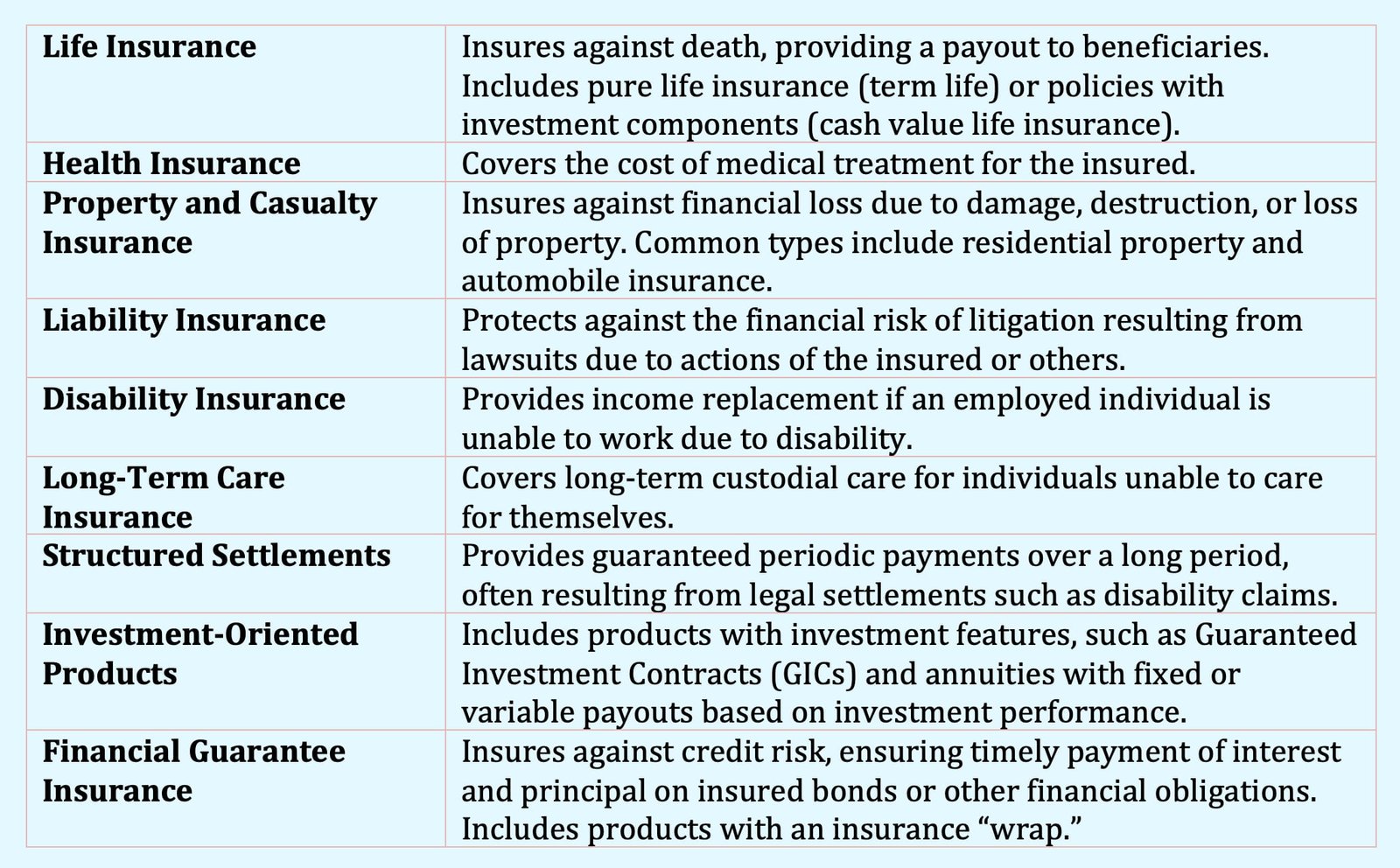

The insurance products sold by insurance companies include:

- Life insurance

- Health insurance

- Property and casualty insurance

- Liability insurance

- Disability insurance

- Long-term care insurance

- Structured settlements

- Investment-oriented products

- Financial guarantee insurance

Life Insurance

Policies insure against death with the insurance company paying the beneficiary of the policy in the event of the death of the insured. Life policies can be for pure life insurance coverage (e.g., term life insurance) or can have an investment component (e.g., cash value life insurance).

Health Insurance

The risk insured is the cost of medical treatment for the insured.

Property and Casualty Insurance

The risk insured against financial loss resulting from the damage, destruction, or loss to property of the insured property attributable to an identifiable event that is sudden, unexpected, or unusual. The major types of such insurance are (1) a residential property house and its contents and (2) automobiles.

Liability Insurance

The risk insured against is litigation, the risk of lawsuits against the insured resulting from the actions by the insured or others.

Disability Insurance

This product insures against the inability of an employed person to earn an income in either the insured’s own occupation or any occupation.

Long Term Care Insurance

This product provides long-term coverage for custodial care for those no longer able to care for themselves.

Structured Settlements

These policies provide for fixed guaranteed periodic payments over a long period of time, typically resulting from a settlement on a disability or other type of policy.

Investment Oriented Products

The products have a major investment component. They include a guaranteed investment contract (GIC) and annuities. In the case of a GIC, a life insurance company agrees that upon the payment of a single premium, it will repay that premium plus a predetermined interest rate earned on that premium over the life of the policy.

While there are many forms of annuities, they all have two fundamental features:

- Whether the periodic payments begin immediately or are deferred to some future date.

- Whether the dollar amount is fixed (i.e., guaranteed dollar amount) or variable depending on the investment performance realised by the insurer.

Financial Guarantee Insurance

The risk insured by this product is the credit risk that the issuer of an insured bond or other financial contract will fail to make timely payment of interest and principal.

A bond or other financial obligation that has such a guarantee is said to have an insurance “wrap.” At one time, a large percentage of bonds issued by municipal governments were insured bonds, as well as asset-backed securities.