Table of Contents

Investment Banks

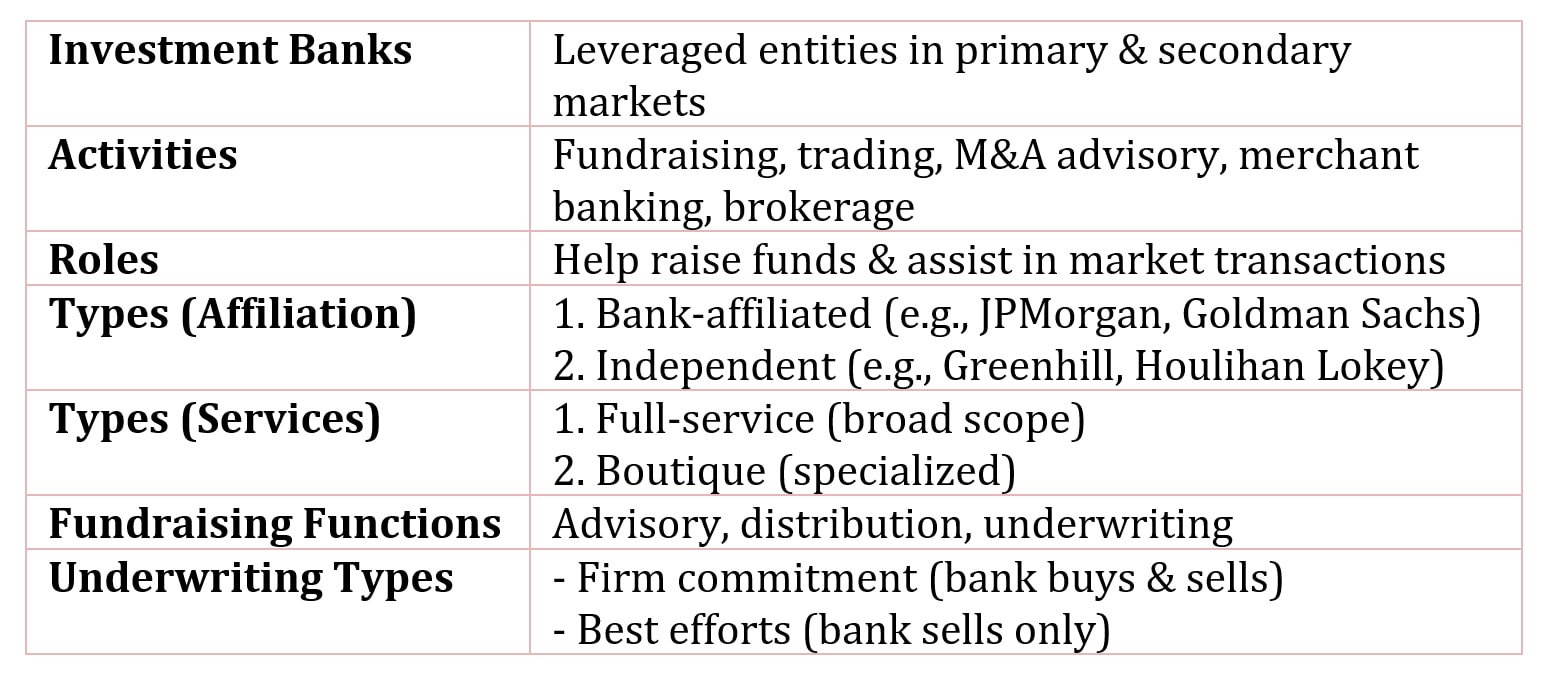

Investment banks are highly leveraged entities that play important roles in both the primary and secondary markets.

Investment banking activities include:

- Raising funds through public offerings and private placement of securities.

- Trading of securities.

- Mergers, acquisitions, and financial restructuring advising.

- Merchant banking.

- Securities finance and prime brokerage services.

The first role is assisting in the raising of funds by corporations, U.S. government agencies, state and local governments, and foreign entities (sovereigns and corporations). The second role is assisting investors who wish to invest funds by acting as brokers or dealers in secondary market transactions.

The investment banking classified into two categories:

- Companies affiliated with large financial services holding companies.

- Companies that are independent of a large financial services holding company.

The large investment banks are affiliated with large commercial bank holding companies. Examples of bank holding companies, referred to as bank-affiliated investment banks, are Banc of America Securities (a subsidiary of Bank of America), JPMorgan Securities (a subsidiary of JPMorgan Chase), and Wachovia Securities (a subsidiary of Wells Fargo), and Goldman Sachs.

The second category of investment banks, referred to as independent investment banks, is a shrinking group. As of mid-2008, this group includes Greenhill & Company and Houlihan Lokey Howard & Zukin.

Another way of classifying investment banking companies is based on the types of activities (i.e., the lines of business) in which they participate:

- Full-service investment banks and boutique investment banks.

- The former are active in a wide range of investment banking activities while the latter specialize in a limited number of those activities.

In assisting entities in the raising of funds in the public market, investment bankers perform one or more of the following three functions:

- Advising the issuer on the terms and the timing of the offering.

- Distributing the issue to the public.

- Underwriting.

Advisory Role of Investment Banks

In their advisory role, investment bankers may be required to design a security structure that is more appealing to investors than currently available financial instruments.

Distribution Function of Investment Banks

The distribution function is critical to both the issuer and the investment bank. To realize the gross spread, the entire securities issue must be sold to the public at the planned reoffering price and, depending on the size of the issue, may require a great deal of marketing effort. The members of the underwriting syndicate will sell the newly issued security to their investor client base. To increase the potential investor base, the lead underwriter(s) will often put together a selling group. This group includes the underwriting syndicate plus other companies not in the syndicate with the gross spread then divided among the lead underwriter(s), members of the underwriting syndicate, and members of the selling group.

Underwriting Function of Investment Banks

The underwriting function involves the way in which the investment bank agrees to place the newly issued security in the market on behalf of the issuer. The fee earned by the investment banking company from underwriting is the difference between the price it paid to the issuer for the security and the price it reoffers the security to the public (called the reoffering price). This difference is referred to as the gross spread.

There are two types of underwriting arrangements:

- Firm commitment

- Best efforts

Firm Commitment

In a firm commitment arrangement, the investment bank purchases the newly issued security from the issuer at a fixed price and then sells the security to the public at the reoffering price.

Typically in a firm-commitment underwriting there will be several investment banks involved because of the capital commitment that must be made and the potential loss of the company’s capital if the newly issued security cannot be sold to the public at a higher price than the purchase price. This is done by forming a group of companies to underwrite the issue, referred to as an underwriting syndicate by the lead underwriter or underwriters. The gross spread is then divided among the lead underwriter(s) and the other companies in the underwriting syndicate.

Best Efforts

In a best-efforts underwriting arrangement, the investment banking firm does not buy the newly issued security from the issuer. Instead, it agrees only to use its expertise to sell the security to the public and earns the gross spread on only what it can sell.