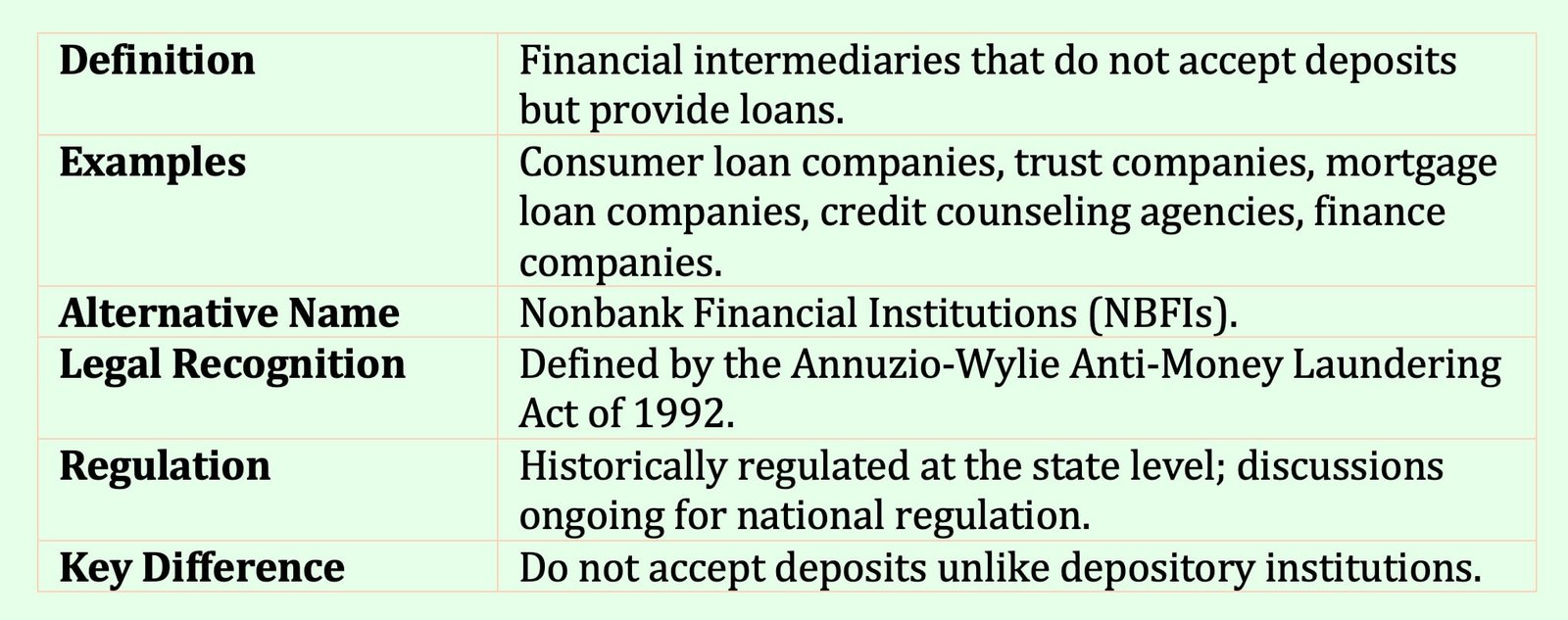

Non-depository Financial Institutions

Non-depository financial institutions are intermediaries that do not accept deposits, but lend funds to consumers and businesses.

Examples of these institutions include consumer loan companies, trust companies, mortgage loan companies, credit counseling agencies, and finance companies.

Non-depository financial institutions are also referred to as nonbank financial institutions (NBFIs). The distinction of these types of companies as financial institutions was made starting with the Annuzio-Wylie Anti-Money Laundering Act of 1992, which broadened the definition of a financial institution beyond deposit accepting institutions.

Unlike depository institutions, non-depository financial institutions have been regulated only at the state level in the U.S., but there is a current discussion on increased regulation of these institutions on the national level, especially in the case of failures of large nondepository financial institutions.