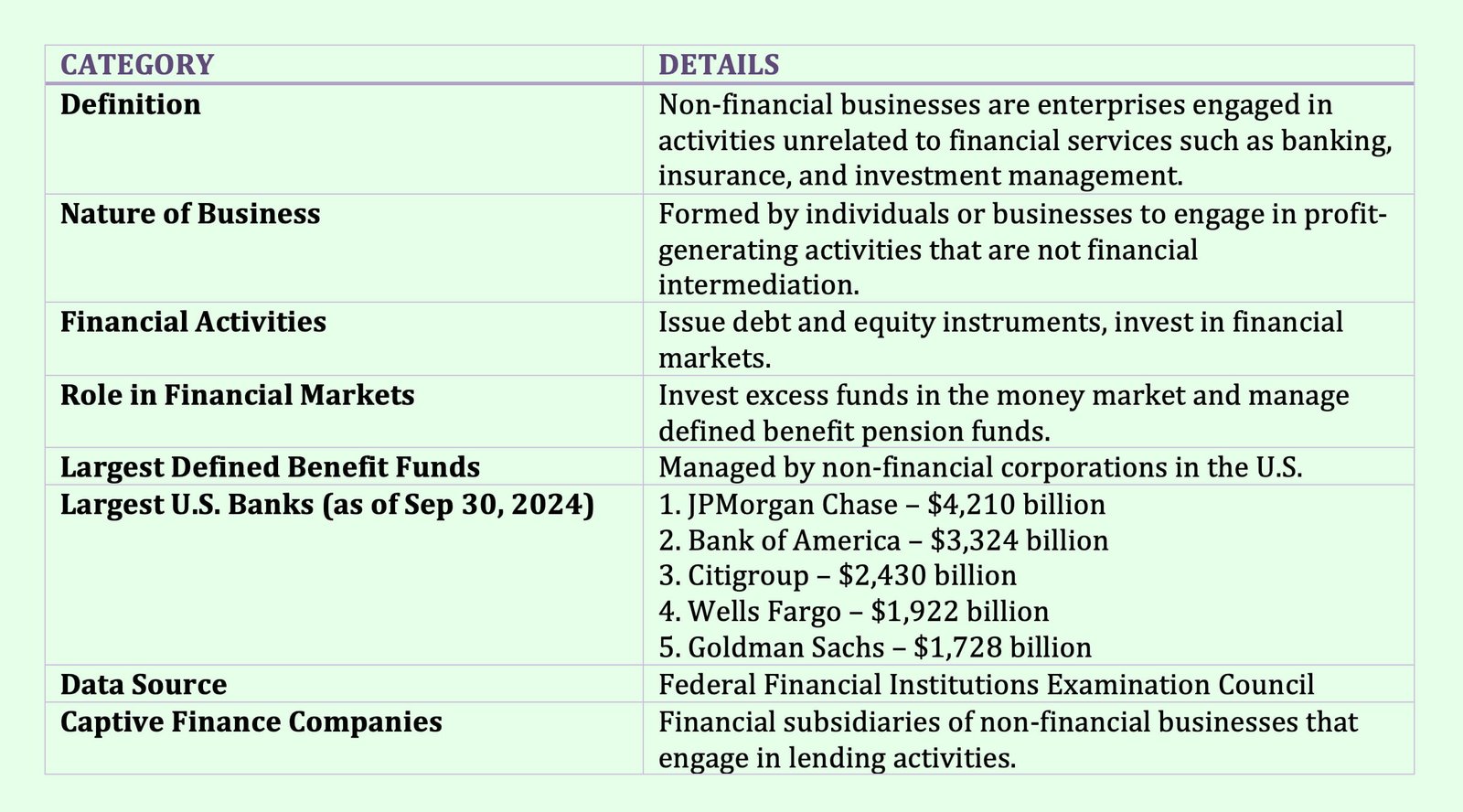

Non-financial Businesses

Non-financial businesses are enterprises that primarily engage in activities unrelated to financial services such as banking, insurance, and investment management.

Non-financial businesses are enterprises formed by individuals and other businesses to engage in activities for a profit, where these activities are not primarily those of a financial intermediary, such as a commercial bank.

These businesses issue debt and equity instruments, and they invest in financial markets.

Businesses participate as investors in the financial market by investing excess funds in the money market and, as with state and local governments, invest the funds of the defined benefit plans in which they sponsor. The largest defined benefit pension funds of businesses in the United States are those of non-financial corporations.

As of September 30, 2024, the five largest banks in the United States by total assets are:

- JPMorgan Chase: $4,210 billion

- Bank of America: $3,324 billion

- Citigroup: $2,430 billion

- Wells Fargo: $1,922 billion

- Goldman Sachs: $1,728 billion

These figures are reported by the Federal Financial Institutions Examination Council. Some non-financial businesses have subsidiaries that are involved in the same activities as financial corporations. The financial subsidiaries, which we refer to as captive finance companies, participate in the financial market by lending funds.