Table of Contents

Pension Funds (PFs)

Pension Funds (PFs) are investment pools that accumulate and manage retirement savings on behalf of employees.

A pension plan fund is established for the eventual payment of retirement benefits.

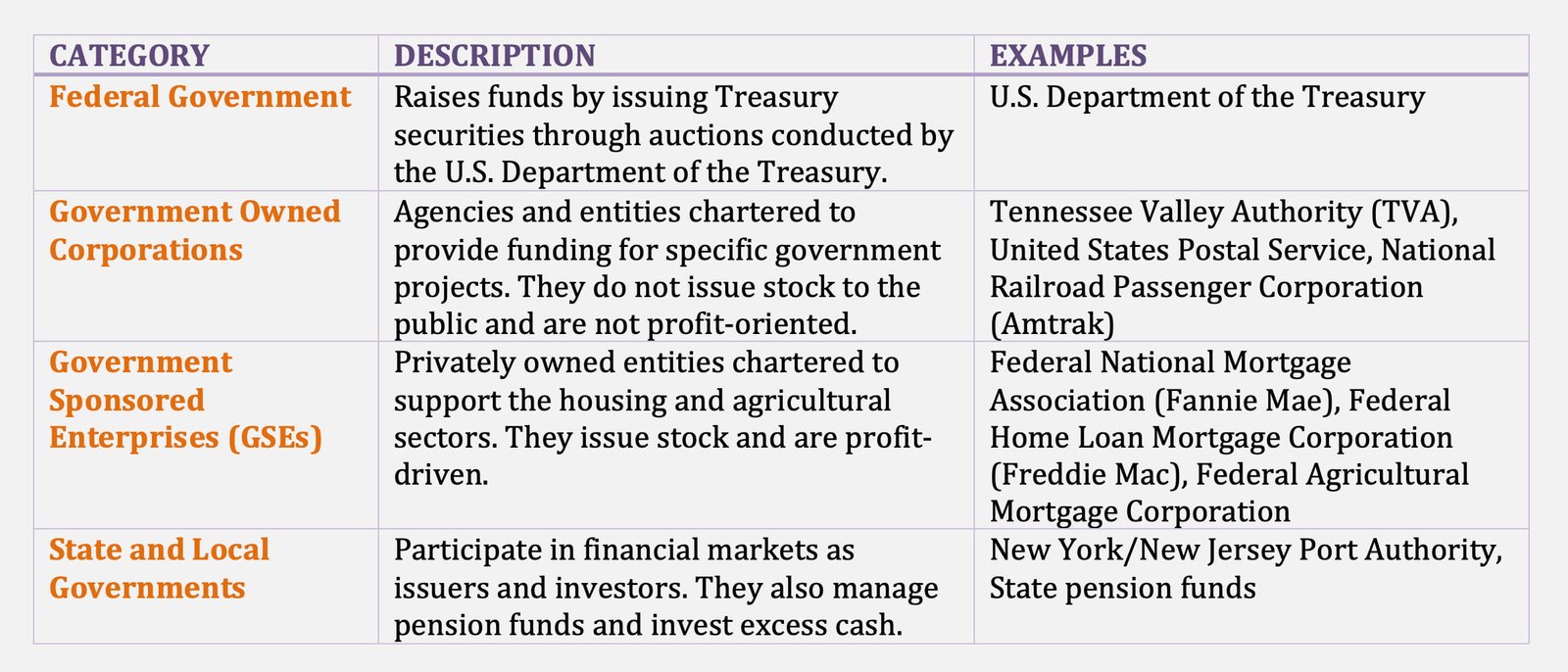

A plan sponsor is the entity that establishes the pension plan. A plan sponsor can be:

- A private business entity on behalf of its employees, called a corporate plan or private plan.

- A federal, state, and local government on behalf of its employees, called a public plan.

- A union on behalf of its members, called a Taft-Hartley plan.

- An individual, called an individually sponsored plan.

Two basic and widely used types of pension plans are:

- Defined benefit plans

- Defined contribution plans

In addition, a hybrid type of plan, called a cash balance plan, combines features of both pension plan types.

Defined Benefit Plans

In a defined benefit (DB) plan, the plan sponsor agrees to make specified dollar payments to qualifying employees beginning at retirement (and some payments to beneficiaries in case of death before retirement).

Effectively, the DB plan pension obligations are a debt obligation of the plan sponsor and consequently the plan sponsor assumes the risk of having insufficient funds in the plan to satisfy the regular contractual payments that must be made to currently retired employees as well as those who will retire in the future.

Defined Contribution Plans

In a defined contribution (DC) plan, the plan sponsor is responsible only for making specified contributions into the plan on behalf of qualifying participants with the amount that it must contribute often being either a percentage of the employee’s salary and/or a percentage of the employer’s profits.

The plan sponsor does not guarantee any specific amount at retirement. The amount that the employee receives at retirement is not guaranteed, but instead depends on the growth (therefore, performance) of the plan assets.

The plan sponsor does offer the plan participants various options as to the investment vehicles in which they may invest. Defined contribution pension plans come in several legal forms: 401(k) plans, money purchase pension plans, and employee stock ownership plans (ESOPs).

Hybrid Type of Plan

A hybrid pension plan is a combination of a defined benefit and defined contribution plan with the most common type being a cash balance plan. This plan defines future pension benefits, not employer contributions.

Retirement benefits are based on a fixed amount annual employer contribution and a guaranteed minimum annual investment return.

Each participant’s account in a cash balance plan is credited with a dollar amount that resembles an employer contribution and is generally determined as a percentage of pay.