Table of Contents

The Money Markets

The money markets are a component of the financial system, facilitating short-term borrowing and lending of funds, typically with maturities of one year or less.

The money market is the sector of the financial market that includes financial instruments with a maturity or redemption date one year or less at the time of issuance.

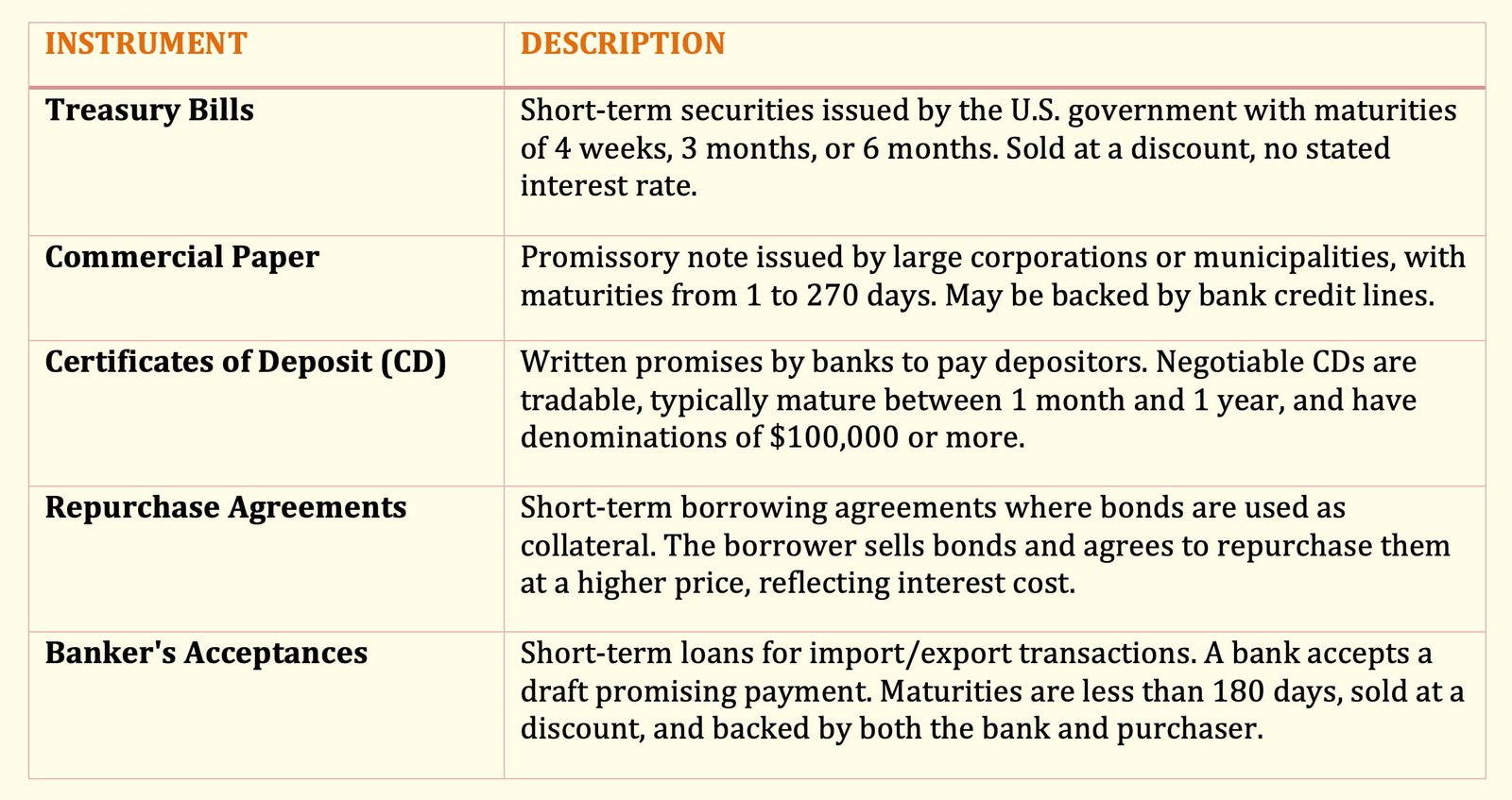

Typically, money market instruments are debt instruments and include:

- Treasury bills

- Commercial paper

- Certificates of deposit (CD)

- Repurchase agreements

- Banker’s acceptances

Treasury Bills

Treasury bills (popularly referred to as T-bills) are short-term securities issued by the U.S. government; they have original maturities of four weeks, three months, or six months. T-bills carry no stated interest rate.

Instead, the government sells these securities on a discounted basis. This means that the holder of a T-bill realizes a return by buying these securities for less than the maturity value and then receiving the maturity value at maturity.

Commercial Paper

Commercial paper is a promissory note—a written promise to pay—issued by a large, creditworthy corporation or a municipality. This financial instrument has an original maturity that typically ranges from one day to 270 days.

The issuers of most commercial paper back up the paper with bank lines of credit, which means that a bank is standing by ready to pay the obligation if the issuer is unable to. Commercial paper may be either interest bearing or sold on a discounted basis.

Certificates of Deposit (CD)

Certificates of deposit (CDs) are written promises by a bank to pay a depositor. Investors can buy and sell negotiable certificates of deposit, which are CDs issued by large commercial banks.

Negotiable CDs typically have original maturities between one month and one year and have denominations of $100,000 or more. Investors pay face value for negotiable CDs and receive a fixed rate of interest on the CD. On the maturity date, the issuer repays the principal, plus interest.

A Eurodollar CD is a negotiable CD for a U.S. dollar deposit at a bank located outside the United States or in U.S. International Banking Facilities. The interest rate on Eurodollar CDs is the London Interbank Offered Rate (LIBOR), which is the rate at which major international banks are willing to offer term Eurodollar deposits to each other.

Repurchase Agreements

Another form of short-term borrowing is the repurchase agreement. To understand a repurchase agreement, we will briefly describe why companies use this instrument. There are participants in the financial system that use leverage in implementing trading strategies in the bond market.

That is, the strategy involves buying bonds with borrowed funds. Rather than borrowing from a bank, a market participant can use the bonds it has acquired as collateral for a loan. Specifically, the lender will loan a certain amount of funds to an entity in need of funds using the bonds as collateral.

We refer to this common lending agreement as a repurchase agreement or repo because it specifies that the borrower sells the bonds to the lender in exchange for proceeds, and at some specified future date, the borrower repurchases the bonds from the lender at a specified price. The specified price, called the repurchase price, is higher than the price at which the bonds are sold because it embodies the interest cost that the lender is charging the borrower.

The interest rate in a repo is the repo rate. Thus, a repo is nothing more than a collateralised loan; that is, a loan backed by a specific asset. We classify it as a money market instrument because the term of a repo is typically less than one year.

Banker’s Acceptances

Banker’s acceptances are short-term loans, usually to importers and exporters, made by banks to finance specific transactions. An acceptance is created when a draft (a promise to pay) is written by a bank’s customer and the bank “accepts” it, promising to pay. The bank’s acceptance of the draft is a promise to pay the face amount of the draft to whoever presents it for payment.

The bank’s customer then uses the draft to finance a transaction, giving this draft to the supplier in exchange for goods. Because acceptances arise from specific transactions, they are available in a wide variety of principal amounts.

Typically, bankers’ acceptances have maturities of less than 180 days. Bankers’ acceptances are sold at a discount from their face value, and the face value is paid at maturity. The likelihood of default on bankers’ acceptances is very small because acceptances are backed by both the issuing bank and the purchaser of goods.